Section A

Summary

There are different questions on an online annual return depending on the size of the charity, but every charity must answer Section A.

Section A is spread across two pages. After that, questions that don't apply to your charity won't appear on your online annual return.

If something isn't right, you won't be able to continue after you click ‘Save & next’ and there will be an error message in red next to the question that needs changed.

If you are a Cross Border charity or a Registered Social Landlord, some of the questions may not appear because they are not relevant.

A video explaining how to answer the questions in Section A can be viewed below. Alternatively, please click on the expanding sections after it to read more about how to answer a question. Remember, after completing Section A, charities with a gross income of £25,000 or more will have to fill in Section B and charities with a gross income of £250,000 or more will have to complete Sections B and C before being asked to submit their required documentation.

The initial questions in Section A will already be filled in using the information we hold about your charity.

This includes the contact details for your charity’s principal contact.

If you need to make changes to the contact details, you can do so where indicated on the form.

A SCIO’s contact must live in Scotland.

Please enter phone and fax numbers without spaces.

There are a few questions on this page that we would like to explain further.

The Scottish Charity Register must contain a separate entry for each charity. This should contain the address of the principal office of the charity. Where the charity does not have a principal office, you will need to supply the name and address of one of its charity trustees. This information will be shown on the Scottish Charity Register (for example ‘Charity Trustee – Mrs A Smith’).

The Principal Office or Trustee Address must be an address at which you will be able to deal with all official notices and letters which you receive from OSCR. If you use a PO Box number, you must still provide a physical address and postcode.

We can use the Alternative Contact Email to get in touch with the charity if there are any problems with the principal email address.

When all of the details are complete and correct, hit ‘Save & Next’.

This is the date of your charity’s financial year end, sometimes known as the year end date or period end date. This information is shown on the Scottish Charity Register. This information will already be filled in.

Changing your Accounting Reference Date will change the date your annual return and accounts are due (the deadline is 9 months following your year end date). If you want to change the Accounting Reference Date, save your progress, go to ‘Home’ then ‘Click here to View and Update your Charity Details’ and finally ‘Update’ and make the necessary change.

This is the total income from:

- total receipts if your charity prepares receipts and payments accounts

OR

- the Statement of Financial Activities if your charity is preparing accrued accounts.

Receipt of any donated asset which legally has to be held within a permanent or expendable endowment fund should not be included.

This is the total expenditure from:

- total payments if your charity prepares receipts and payments accounts

OR

- the Statement of Financial Activities if your charity is preparing accrued accounts.

If you publish the accounts on your charity’s own website answer ‘yes’ to this question and insert the direct link in section 4b. OSCR will include this link to your accounts information on your charity’s register entry.

It is a great way of you reaching a wider public, as you can also include other information you would like the public to see on the page that contains your accounts.

Add the link to where we can find the accounts on your charity’s website.

If you do this, this link will appear in the 'Latest Accounts' column in your charity's entry in the Scottish Charity Register.

This is a great way for a charity to share their reports and accounts on our register. If you do not provide a link, your charity's register extract may contain a set of redacted accounts published by OSCR (depending on its legal form or income threshold), or a link to another regulator that may hold your accounts. Providing a link to us can have the added bonus of your charity using the linked page on your website to share other information about its activities and impact. Please note you will still have to upload accounts later in the online annual return even when you give us a link.

Your charity’s purpose is stated on the charity’s entry on the Scottish Charity Register.

In order to achieve the purposes stated on the Register, does your charity do any of the things in this list? Please tick all the options that apply, and if your charity does any things not listed, please describe these in the space provided under ‘Other’.

If your charity receives income from investments – for example stocks, shares or bonds, please choose yes. For the purposes of this question, we do not include bank interest as investment income.

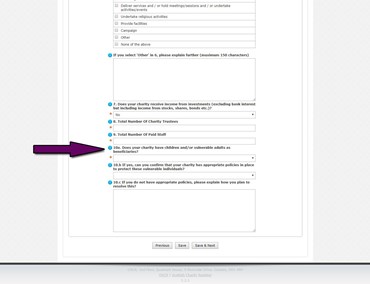

A charity trustee is a person having general control or management of the running of a charity. Enter the number of trustees and staff in these questions at the accounting period end date.

Please let us know if your charity has children or vulnerable adults as beneficiaries of your charitable activities.

Read our Safeguarding Guidance for information on what you might need to do depending on your charitable activities.

For Cross Border charities, (those registered with both OSCR and the Charity Commission for England and Wales) the Information Return has been replaced by one specific additional Yes/No question on the online annual return. This question is about undertaking activities in Scotland and will only appear if relevant.

If your charity has a gross income of less than £25,000, when you click ‘Save and Next’ you will be asked to submit the charity’s required documentation.

Click here for instructions on how to submit documentation.

If your charity's gross income is £25,000 or more, you will be asked more questions on the next page.